Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

HODL is a "slang" term used in the "crypto" community to denote "Hold". As with many other Internet-centric "slang" phrases, it was coined as a way to describe the excitement someone would experience from seeing the "crypto" prices swinging.

Most people involved with the "crypto" space are testosterone-fuelled young men, who typically inhabit the numerous forums and online communities dedicated to the "crypto" space. In the heated discussions carried out online, these young men get over-excited and end up typing "HODL" quickly...

The term grew after the rise of Bitcoin in 2013. It grew because most people were going to sell their "coins" the minute they dropped below $300. This is a newbie mistake, and as such most experienced traders were telling them to hold onto their holdings, as the price would invariably increase.

To this end, if you're looking at which "slang" word was most commonplace in the "crypto" community, it's HODL. It's used to describe the way in which you need to hold your portfolio no matter what (as the price will invariably increase again).

We've found that the use of "HODL" as a term has now extended into a more common concept for the crypto space as a whole; allowing users to essentially stand by their investments no matter what.

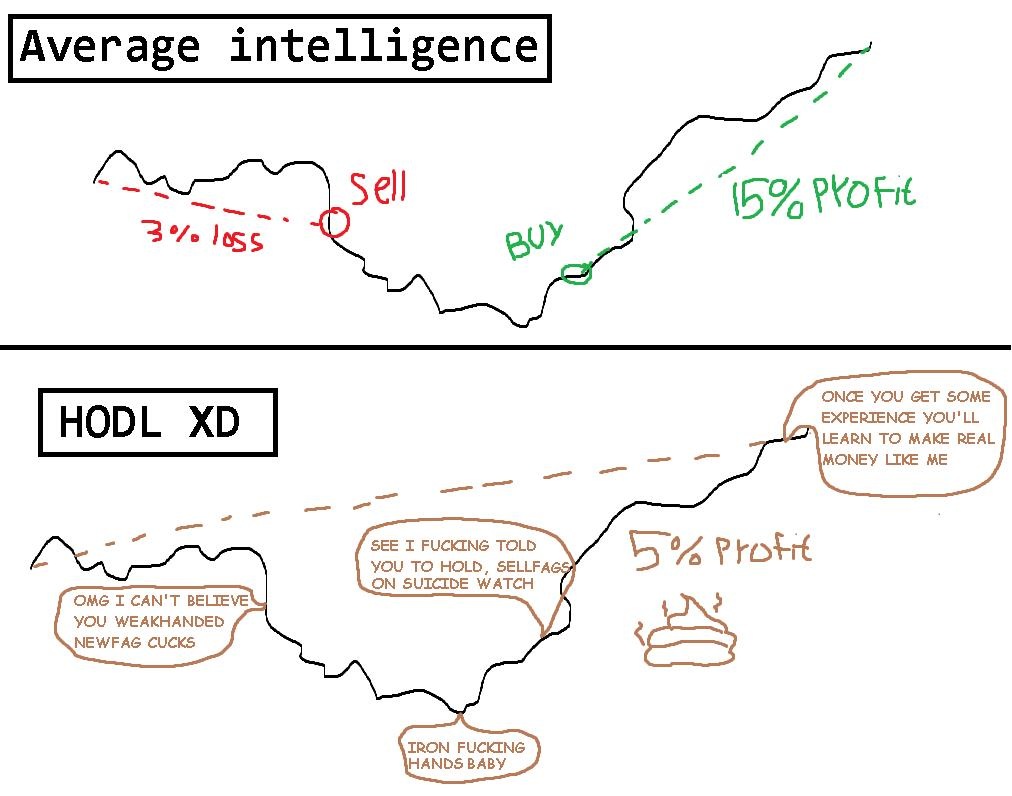

In order to fully understand the role the word plays in the market, you have to appreciate how people actually "make money" with the crypto space. The ONLY way that "crypto" tokens make money is when someone buys one for a low price, and sells for a much higher one.

There is no revenue generation from the coins themselves, and the system is basically designed to provide users with the ability to determine any of the potential problems that it may have. In other words, it means that if you're looking at getting investment return from the coins, you need to essentially buy low, sell high.

The "selling high" part is where most people crumble. They sell when the price his rock bottom (which is the worst time to do so), and end up losing money. This not only means that you're looking at trying to get the most out of your investment, but you also need to appreciate market dynamics. This is what we'll explain briefly...

The most important thing to note here is that if you're looking at "crypto" as an investment, you're basically playing with other people in the market. The "market" is primarily driven by emotion, and thus it experiences "booms and busts"...

To this end, the most important thing to realize is that if you're looking at the "crypto" space, and particularly the Bitcoin price (which has a waterfall effect with other "alt" coins), the price is likely going to fall and rise at different times.

This is why most people end up chanting "HODL" - they think that for some strange reason, the price of BTC - and the plethora of other "alt" coins - is going to magically rise overnight.

Unfortunately, most of the smaller coins that have recently been created will not grow very far. Even if they are hyped to oblivion, and quadruple overnight, the simple reality is that since they don't have any assets backing them, they will end up with menial gains at best.

In this case, "HODL" will typically be quite an ineffective process to follow...