Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

The ultimate question of the "crypto" era - who's holding the cash?

The answer is actually simple - no one. The money you paid for a "coin" went straight into the back-pocket of the person who owned it before you. If you did not know this, and think that it sounds very similar to a ponzi scheme, that's because it is.

"Crypto" doesn't have any intrinsic value (apart from the ability to transfer money between parties that may not have been able to use it before). This means that the "price" of each "coin" is determined solely by what the "other guy" is willing to pay for them, hence the volatility.

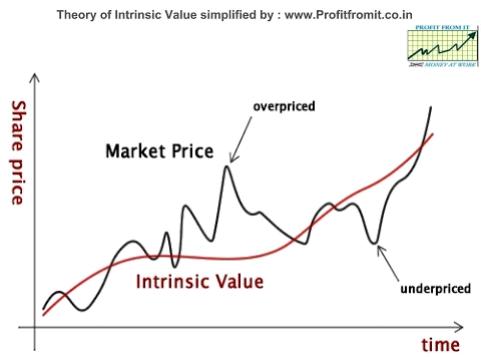

To give context, when you deal with finance & investing, you're basically looking at the "intrinsic value" of an underlying asset, and the "price" is meant to reflect that value...

Obviously, it never happens that way because the market is driven by hearsay and speculation, rather than logic and reason. This is why the system experiences booms and busts - as people become greedy and fearful.

The most effective investors call themselves "value" investors - which is to say they focus primarily on the way in which they are determining the underlying value of a particular product. This value essentially gives the investor the ability to determine a "price" which can then be ascribed to it in the market.

If an asset is "over" priced, it means that its price is too high compared to its intrinsic value; too low and it's known as "under" priced.

The most important thing to realize is that "crypto" doesn't have anywhere near the intrinsic value that people think it does. It's not a "currency" and is not going to "change the world" as most idiots think. It's - at best - a payment network designed to provide people with the ability to send/receive money directly with others (not using a central bank / data provider).

This means that if you're looking at investing into the system, you really need to be able to find the reason why it can justify the price. This tutorial is going to explain how...

The way Bitcoin works is to provide people with the ability to "buy" Bitcoins from others, and send them to others. The other people can then "sell" the Bitcoin in order to get fiat currency back out of the system.

To this end, in order to build out the underlying infrastructure of the "Bitcoin" network, you need to be able to ascribe any particular price to the "coins" that you can. This is where most people have found the profit-making potential of the system, and thus have been trading the coins.

Unfortunately, the "coins" themselves don't actually make any money on their own. They don't have any value in that sense, and they do not "hold" value (as explained by many people). This means that if you're looking at getting the most out of the system, avoid holding onto the coins for any period of time.