Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

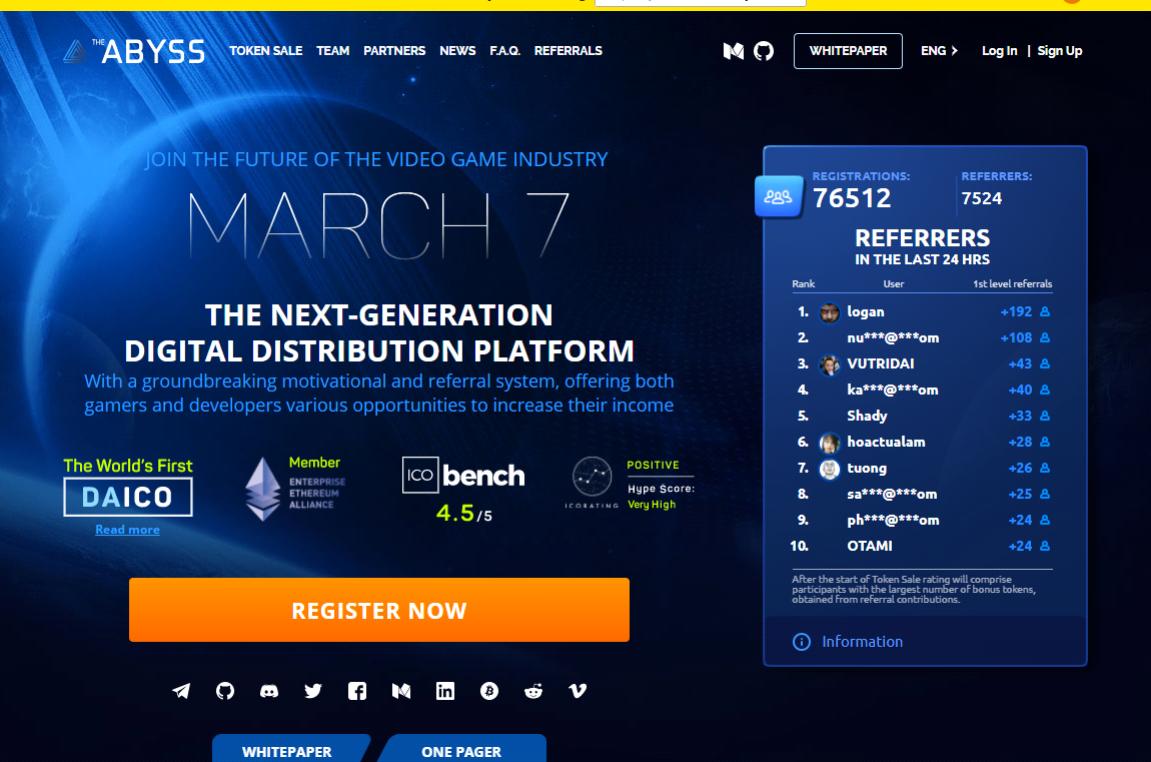

Initial Coin Offerings (ICO's) are events whereby a new "coin" operator will basically create a means through which they're able to sell any new "coins" in their new "crypto" system...

ICO's are typically used to generate capital for new "crypto" projects - they work similarly to "IPO's" in the real world, except they're entirely focused on the crypto space.

They will take "crypto" tokens as a means of payment for participants. The participants then receive tokens in the new ICO, which they hope will increase in value over the duration of its life.

Whilst the idea of an "ICO" is indeed very interesting, many people have highlighted the major problem with them - that they're entirely unregulated.

Regulation in the financial world acts as a means to provide consumers with a level of security that allows them to trust banks / financial institutions. Without it, the safetynet provided by the regulatory oversight erodes - leading most people to be unable to manage the way they're working.

To this end, when looking at the ICO market - you're basically looking to identify any of the "tokens" which actually have the chance of being somewhat successful in the long run.

Lots of morons buying these tokens in the hope they'll somehow give them a "Lambo on the moon" - the simple fact is the majority of ICO's are operated either by woefully inexperienced individuals, or people who should not be involved with business at all. This is where their association with being "scams" has come from.

90% of ICO's are scams. They don't deliver on their promises, leading most people to lose money with them, thus leading them to be seen as a waste of money. And because they're not regulated, there's very little the authorities can do.

This tutorial is going to explain how they work, and whether they are scams or not...

ICO's provide users with the ability to buy into newly created "crypto" tokens without the need to do any of the work associated with bringing them to reality.

Most pertinently, it means that if you get any ICO tokens very cheaply, and the stock price increases massively, you've made a substantial profit from doing nothing.

The ICO works very similarly to an IPO in the "finance" world - which is to say that it's used to help the company raise capital. However, unlike the finance world, an ICO has no economic footing / feasibility. They are just random "tokens" created by fake companies that have very little merit.

ICO's are extremely high risk (typically because they can be designed by anyone - there's VERY little barrier to entry with them). Not only does that mean that people who buy into them have very little by way of protection, but the companies behind the various products often over-inflate their ideas etc.

Whilst there have been 1000+ ICO's from all around the world, only the coins that actually provide asset-backed business opportunities have survived. To this end, it's vital that if you're looking at buying various "crypto" tokens in the ICO stage, you at least look at who the company is behind them. Most are not trustworthy at all.

Ultimately, most ICO's are actually legitimate. However, just like 99.9% of the other "crypto" tokens, they aren't worth anything. The only ones worth dealing with are the few that are actually backed by real business acumen.

Unfortunately, a number of people have experienced "scamming" in the ICO world has grown inexorably, leading to the reputation that all ICO's are scams. They are not, but basically have a tendency to be that way.

If you are even considering buying into some ICO, you need to remove any thoughts/ideas that you will be able to do so without the tools themselves.