Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

The simple answer is no.

They may change, but they won't fail. They have too much adoption (they've already reached "critical mass"), meaning that they'll likely have to adapt to new legislation etc, but generally won't have problems with their underlying technology.

For all the ills of the "Bitcoin" boom - one thing is for certain; the technology itself has proven itself more than adequate for its intended purpose. It has not buckled under pressure, and has not lead to any sort of problem with the way the system works.

Whilst there are obvious deficiencies within the system - such as transaction times and high fees - the way in which Bitcoin works (in principle) is still sound. This means that it will not "fail" - but may change.

The most important thing to realize is that it's not the technology which will determine the future direction of BTC / others, it's the economics of it all. The economics will either give rise to future adoption of the various "coins", or will force them to change.

In either instance, it's vital to understand the way in which the systems work as to provide users with the opportunity to make the most out of them. This tutorial looks to do that...

The big misconception is that "crypto" is going to replace the "fiat" currencies of the world.

This is false. "Crypto" is software - it does not retain, hold or create value for any transactions - it's simply a way to facilitate transactions between two or more people...

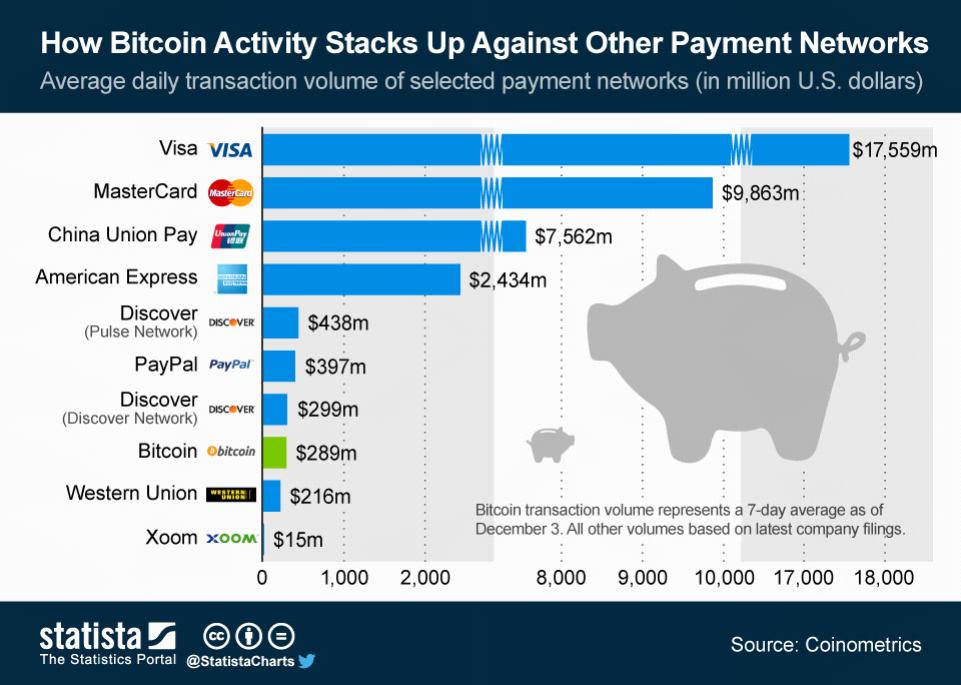

How those transactions work is up to the users (and why governments have tried to regulate the system); the underlying reality is that Bitcoin (and other "crypto" systems) are simply PAYMENT NETWORKS - designed to transfer the ownership of "digital assets" from one person to another.

The reason why they are able to function is because of what Richard Nixon did in the 1970's - be extricating the US from the Bretton Woods System, Nixon essentially removed the USD from being dependent on Gold for its value. This meant that the Federal Reserve and other governmental organizations could essentially "print" money, thus tying its value to both debt and the underlying economic structure.

This is important because it means that it pushed "banks" from being "stores" of value, to simply transferring an ever-increasing supply of paper money from one account to another. In other words, the numbers you could see on "account" screens were almost entirely made up, with very little by way of regulation/self-limiting on the amount the numbers could grow. Whilst this made the US the dominant economic player in the cold war, it now has lead to an explosion in consumer debt, massive student loans and an ever shrinking middle-class wage pool.

Bitcoin was introduced as a way to solve this problem. Satoshi Nakamoto (the anonymous creator of the "currency") designed it as a way to provide "currency" type usage without the control of governments / regulators. Indeed, the first "block" in the Bitcoin blockchain was a direct reference to the UK's second bank bailout - seen by many as the quintessential demonstration of lack of control in the money markets.

This is all well and good - however, you need to understand something important... money isn't stupid. It's like water - constantly moving and adapting to the environment in which it finds itself. If it's in a restrictive environment, it will typically take the form of essential items (food/water/heat); in a more abundant environment, it will take the form of consumer items.

The point is that whilst Bitcoin was aimed at fixing the underlying financial system, it cannot do that without having an asset base to control. The real reason why Nixon's gamble in getting rid of the Bretton Woods agreement was that whilst it opened the Pandora's box of inflation, it also gave rise to a rampant consumer market that still pushes the world's economy forward today. This market is underpinned by a MASSIVE asset-base - represented by the various "stock" markets in each country.

Bitcoin has no bearing on these stock markets, does not hold any assets in reserve and thus cannot be considered and indicator of "value". Its sole reason for existing is to allow for people to move "money" from one "Bitcoin Address" to another. This is done by allowing the users to "buy" the various coins that BTC has created - hence why they have a price. Bitcoin has no real "value" in the sense that it cannot be swapped for the likes of energy/heat/food - but can facilitate transactions of those things. This is why it cannot "fail" - it's essentially the equivalent of a global marketplace...

The "crypto" market is basically the decentralization of the world's technology. Bitcoin decentralized finances (and is still doing so today).

However, the other "crypto" currencies out there are also responsible for creating certain levels of value - typically in the form of proprietary functionality.

The important thing to note is that ALL "crypto" currencies work in the same way - they provide the ability to transfer money/assets/resources between users of each system.

Because they don't have any underlying asset integration, they are not really providing any sort of "financial" service. People buy their tokens as a means to utilize the functionality of the platform, not as an "investment".

This means that it will likely be the case that the various "crypto" systems will not be outlawed in themselves. They're not causing any problems. What *will* be outlawed / regulated is the way they've been used to try and get people to buy them as an "investment". Bitcoin, Ethereum and Ripple are not investments. They're speculative gambles.

Further to this, the idea that you can put money into the systems and have that money available anywhere in the world has lead the likes of South Korea's & China's governments to regulating the "exchanges" of the various "crypto" systems. This is likely what's in store for the various systems moving forward.