Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

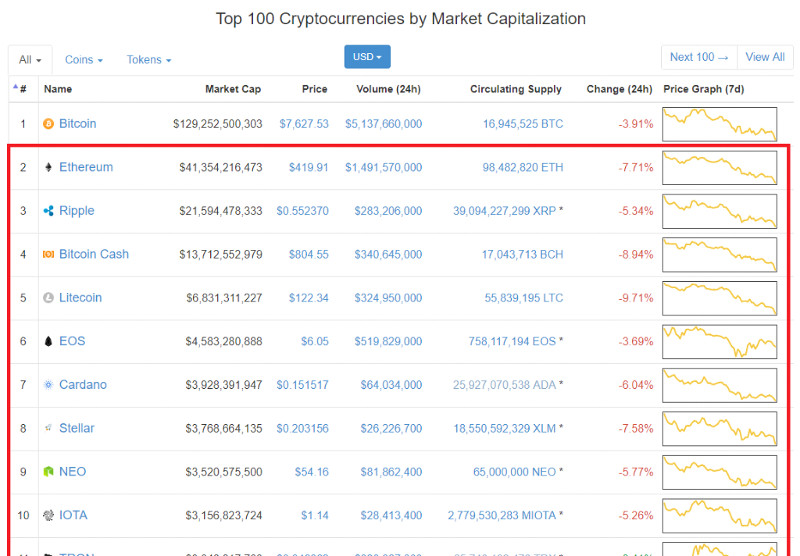

Altcoins are basically any other coin to "Bitcoin" - allowing for the likes of Ethereum, Ripple and a number of other "coins" that had been published on the market...

Whilst they are described as "coins", it's important to remember that every listing above is actually a piece of software. Each software has a different purpose (although most just copy Bitcoin) and thus they are described as "alt" / "alternative" coins.

The "altcoin" market is estimated to be worth upwards of $100bn, with the likes of Ethereum and Ripple remaining at the top since the beginning. Due to the low barriers-to-entry, a huge number of "coins" have been created, most of which make absolutely no money or sense.

To this end, it's important to consider exactly what each "coin" is designed to do, and why it exists. It's also important to understand that the "coins" you're seeing are not equivalent to money, nor are they actually worth anything. The fallacy that you can "get rich" with "crypto" investments is based on the fact that a handful of people made money buying Bitcoins when they were worth $200, selling them at $15,000.

Whilst "alt" coins are obviously the target for similar ideas, the underlying reality is that they are designed to primarily piggyback on the success that "Bitcoin" has enjoyed in the market. This tutorial is going to examine exactly what each "alt" coin is meant to do, what it actually does and whether it's actually worth investing into them...

ALL crypto "coins" are the same thing - a piece of software designed to enable "decentralized" transactions without any central provider.

Obviously, Bitcoin is the perennial winner in the market, having both introduced and popularized the idea. But in the same vein, the plethora of "alternative" systems have been built to provide a plethora of different solutions on top of the same underlying principle.

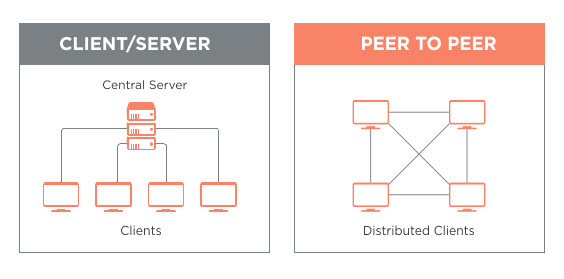

As mentioned, the way that "all" these systems work is through the provision of a network based transaction management system. Rather than having underlying central processor, they all utilize some form of "decentralized" database such as "blockchain" - which is designed to provide users with the ability to engage with each other in a peer-to-peer capacity.

Client/Server is the prevailing technology today. It's how the likes of Facebook, Google and Amazon work - they store data and provide a "platform" through which people are able to engage with it. This is why many people don't trust the likes of FB - their control of people's personal information is extremely vast.

The principle that Bitcoin championed was the idea that you could do away with a central processing service. This would give rise to the idea of "distributed" databases (powered by a network of computer systems - rather than just one central system). This network is what we see today with Bitcoin's "mining" network.

To be specific, Bitcoin introduced a "peer to peer" platform through which people would be able to "send" or "receive" money between each other. Whilst this worked well, the main problem was that Bitcoin itself was unable to manage the various underlying assets that were being transacted through the system, leading to mass volatility in the market.

Regardless of this, the point of "alt" coins was to build on this principle by adding different levels of functionality. Monero and Dash, for example, specialized in "private" transactions; Ethereum wanted to create "smart" contracts and Ripple was a business catering to banks / financial institutions.

Whilst 99% of "crypto" traders have absolutely zero idea about the system, and why it exists, the fact remains that crypto is as much a technical innovation as an economic one. Understanding both realms gives you the ability to determine whether any of the "coins" you see are actually worth the money. This is what we'll look at next...

"Alt" coins are basically created by small developers who create the underlying system / functionality, and then allow others to identify the various ways in which they can be used.

The predominant way in which they can be purchased is through an "ICO" (Initial Coin Offering), which basically means they will be distributed to users who "early stage" investors who may want to purchase them. This system works very similarly to "IPO's" in the real world...

The way the altcoin market works is basically to have a new "coins" (decentralized software system) present its wares to potential investors through a number of different means (typically with ads and events) - it will then invite any investors to "buy" the pre-sale of its coins by trading them for the likes of Bitcoin or Ethereum. During the ICO stage, the trade is typically done straight with the ICO provider. However,as the coins are made public - they may appear on the many "crypto / crypto" exchanges - allowing investors to openly buy them from the market.

A good example of how this process works is with "Harbor" - a new "coin" that was released in early 2018. This raised $10m from a private venture capital fund, as well as running an "ICO". It basically provided a small group of pre-qualified investors with the opportunity to invest into their operation without needing to go down the typical processes.

Once the ICO was secure, the users were able to use the likes of Binance to trade the coins...