Crypto

BlogCrypto to USD

CalculatorWallets &

TransactionsCurrency

ConverterProfit or Loss

CalculatorIs It Too Late

To Invest?Do I Have

Enough Coin?Buy High

Sell LowBuy The Dip

Sell High

Buy Low

Bookmarks

Crypto Purchase History

Portfolio Overview

Transaction History

The most important thing to realize about "crypto" is that it's not a transfer of value; it's simply the means of changing the ownership of underlying assets / currency to someone else.

In other words, getting "paid" in Crypto has nothing to do with the systems themselves, rather the way in which they're able to utilize the current "payment" infrastructure to get giat currency into your account.

Fiat currency is the legal tender for a specific country / economic area. What most people don't understand - and thus are completely oblivious to - is the fact that despite inflation & "quantitative easing", the underlying reason why "fiat" retains value is because the economy it represents actually has assets that completely justify its "price".

Despite debt and other issues, the economies of the West / other parts of the world are still valid, and thus the "fiat" currencies they are represented by provides a foundation of value which the various economies are able to provide for users of those currencies.

"Bitcoin" and other "crypto" systems don't have this connection. This is the main reason for their lack of mainstream adoption currently - they don't have the underlying "asset base" required to encourage their value. Instead, the majority of people who "trade" the coins are doing so with a close connection to the "fiat" currencies they represent.

To this end, when looking at whether you're able to receive your salary or payments via the "crypto" ecosystem, what you need to appreciate is that "crypto" is a payment network, not a "currency" in of itself. This is VERY important, as it should give you the appropriate perspective on what you're actually looking at investing into...

"Crypto" is just the transference of digital asset ownership from one person to another. It's NOT an economy in itself, nor is it a means to "earn" money. The various coins/tokens have very little "value" beyond being used as a means to denote a transaction. In the investment world, this is known as the disparity between "price" and "value"...

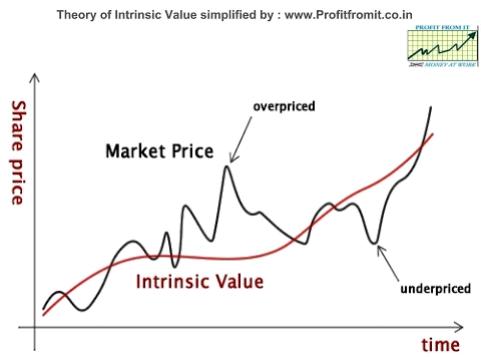

Whilst most newbie traders look at "price", they omit to identify the "value" of a particular asset/commodity. The value is all that counts. It indicates how much "use value" a commodity / asset may have, and thus will determine a price people are willing to pay for it.

The technical term is "intrinsic value" - which basically means -- without all of the pomp & hyperbole, what's the actual reason that people will look at the item, and use it. For example, a particular footstuff (coffee) can be used to stimulate people and thus an office worker may enjoy drinking 2 or 3 in any given day.

The intrinsic value of different assets is calculated with varying degrees of success. This is where the "secret sauce" of most investment banks resided - the ability to spot / calculate the value in different assets before they actually become seen by the market. Spotting growth trends is essentially the only way to "get rich" on the stock market (or now the "crypto" market).

Therefore, when looking at whether you should actually be getting "paid" in "crypto" tokens, you have to determine whether they're actually going to be able to maintain their value or not. This is what will determine the price, and thus whether it's actually going to be worth it for you.

The answer is actually quite simple - the way in which the various "crypto" systems work is to focus on providing users with the ability to trade "directly" with each other (it's something called Peer-To-Peer / P2P). This means that if you're looking at getting paid in the system, you will have to be sure that you are essentially able to "cash out" the coins for real money. This is the difficult many people are currently facing...

If you don't live in the West - where the majority of the financial infrastructure supports millions of financial transactions per day, receiving payment can often be difficult. If you're one of those people - getting "paid" in "crypto" funds could actually be highly recommended; it gives you the stability and flexibility that only the global, decentralized "crypto" system can provide.

However, it does not mean that you're actually going to be financially better off by doing it.

If you get paid in USD/GBP etc, you're basically going to be better off receiving payment directly in your home currency. This gives you the ability to benefit from the stability and scope of the economic value underpinning the currencies.

The big misconception today is that most people are basically looking for a way to "grow" their earnings, and think that "Bitcoin" is going to be a tool through which to do it. This would be feasible if Bitcoin/"crypto" systems were designed around providing an alternative economic model (with assets), but they're not.

Hence, receiving payment in them is only really a viable option if you have trouble receiving your own currency - or that your own currency is severely weakened against the likes of the USD etc...